RESUME

Back to Home

Loan Management System

Micro Finance

Case Study

Concept

Duration

12 Weeks

Industry

Financial Sector, B2C

Brief

LendSure, an AI supported Loan Management System

Provide a hassle free digital experience for users seeking small loan amount, providing accessible, transparent eligibility checks and no hidden transaction charges and high security lending services. Inbuilt repayment reminders & budgeting insights to prevent loan defaults.

Problem

Access to Microfinance loans is a crucial tool for financial inclusion, yet many underserved populations face barriers to obtaining credit

Complex loan application processes that deter first-time users. People having low digital literacy, especially among rural borrowers have trust concerns regarding security and data privacy. Also lack of transparency in loan terms and repayment expectations makes it difficult for users.

Goal

Building a User-Centric, Easy accessible & Trustworthy Mobile first App

The goal was to design a mobile-first Microfinance app that simplifies the loan application and management experience, making it accessible, transparent, trustworthy & secure. Offering AI powered Loan matching and smart approval.

9

Personal Interviews

1

Expert Reviews

3

Main Personas

5

Unique Features

Research

Market Research & Competitive Analysis

Analysis was done on the Indian market to know the competition. By doing so, below were the findings.

Features

KreditBee

MoneyTap

Bajaj Finserv

SmartCoin/Olyv

PaySense

Flexible Loan

Repayment

Real time Loan

EMI Calculation

Other Channel

Support

Emergency Instant

Loans

Not Required

Credit History

or Collateral

Multiple Chanel

Amount Disbursement

Rural & Other

Financial Inclusivity

Mobile First

Experience

Loan Eligibility

Checker

Research

Qualitative Analysis Questionnaire

Do you prefer applying loans in person or online ? and Why ?

Have you used any banking app or tried online for mobile loan disbursement ? If yes what was the experience like?

What is your pain point regarding applying of loans ?

What concerns you while sharing your personal and financial details online ?

How do you know if loan provider is trustworthy ? Have you faced any financial fraud ?

How do you repay your loans? Have you missed repayment ?

What do you think about flexible repayment schedules ?

Are you familiar with basic financial terms ? if not will you feel confident if you have more awareness about it ?

Do you have any challenges in using a mobile financial app in terms of language, internet access, navigation ?

Key Findings from 1:1 interviews

80% of users preferred a mobile-first solution, with minimal desktop interaction.

60% mention security & trust - a significant barrier, as users hesitate to share personal and financial information. And are scared of finding trustworthy online source so they reach out to traditional lenders where they use gold or other collateral.

48% were unsure of eligibility before starting the application.

Most users opting for micro finance do not have basic financial literacy led them to get tangled in repeated debts, leading to mismanagement of daily expenses.

Similarly low-literacy users struggled with text-heavy interfaces, preferring voice-based or pictorial guidance.

User’s taking online loans pay via UPI’s as it is easy and accessible.

62% found lengthy forms discouraging. Loan application complexity led to drop-offs, particularly at document submission & income verification steps.

Research

Quantitative Analysis

General trend observed while collecting basic data are shown below.

18-25

23.1%

36-45

32.1%

26-35

44.9%

Age Range

Range of income per month

Daily Expenses

21.4%

Previous Debt

34.1%

Medical

Emergency

29.4%

Education

6.7%

Business

Investment

8.3%

Biggest reason for taking loan

How do users prefer to repay loans

Monthly

45%

Weekly

40%

Flexible

20%

Persona’s

Based on potential user interaction , the needs of 3 persona’s were concentrated

1. Rajesh (First-time Borrower, 32, Small Business Owner)

Needs quick loans to restock his fruits & vegetables stall.

Struggles with long paperwork and unclear approval timelines.

Prefers mobile apps but has low digital & financial literacy.

2. Gomathi (Freelancer, 27, Self-Employed)

Seeks micro loans to clear off previous debts.

Concerned about repayment flexibility and interest rates.

Wants an app with clear terms and an intuitive interface.

3. James (Salaried Worker, 40, Emergency Borrower)

Needs small loans for medical expenses & school fees.

Prefers automated repayment deductions.

Values transparency in interest rates and fees.

Behavioural

Journey Map

A visual tool that outlines the end-to-end steps a user takes to achieve a target behaviour, including actions, opportunities, and potential barriers. This approach helped us map out the key flows and paths that would help users effectively reach their goals with our app reducing the friction path.

Awareness

I need Personal Loan

Gathers information via peers, online or sees ads about micro finance options

Distrust in online lending apps, unclear eligibility criteria. Doubts if this is a scam.

Provide trust-building elements like testimonials, certifications, and transparent eligibility information.

Consideration

Which lender is trustworthy and offers the best terms

Compares loan terms, reads reviews, checks app ratings, visits website/app

Confusing loan terms, fear of hidden fees, information overload.

Provide a clear loan calculator and comparison tools to simplify decision-making.

First-time Interaction

Will i qualify for applying ?

Installs the app, browses home screen, checks eligibility.

No easy way to check eligibility, unclear process steps.

Add a loan eligibility checker upfront to help users assess their chances before applying

Loan Application - Star

I need to apply, and anticipates on how will the process be.

Fills in basic details, selects loan type and amount.

Long forms, unclear progress, difficult document upload

Implement progressive disclosure (step-by-step form), auto-save feature, and a progress bar.

Verification & Documentation

Hoping this process is fast and secure

Uploads documents (ID, income proof), enters bank details.

Users worry about security, complexity of document requirements.

Show security badges, explain why each document is needed, allow OCR-based automatic form filling.

Loan Approval Process

How long will this take?

Waits for approval, checks notifications.

Long wait times, lack of updates, no way to track application status makes users worry and abandon the application.

Provide real-time tracking, estimated approval time, and proactive updates.

Loan Disbursement

Did I get the money? How do I repay

Gets money in the bank, looks for repayment instructions.

Unclear disbursement timelines, difficulty understanding repayment options.

Send instant notifications, add a clear repayment schedule with reminders.

Repayment & Follow-up

I need to pay back without hassle

Pays via app, sets up auto-debit, requests extensions if needed.

Payment failures, no flexibility, late fee confusion.

Provide multiple payment options, an easy loan extension request feature, and friendly repayment reminders.

Repeat Use or Stops Using

Do i require another loan ?

Either applies for a new loan or stops using the app.

Bad experience = user exits forever.

Trust and convenience = repeat usage.

Offer loyalty benefits, fast approvals for returning users, and post-loan engagement strategies. Help build credit score.

Stages

User Motivation

User Action

Pain points

Opportunities

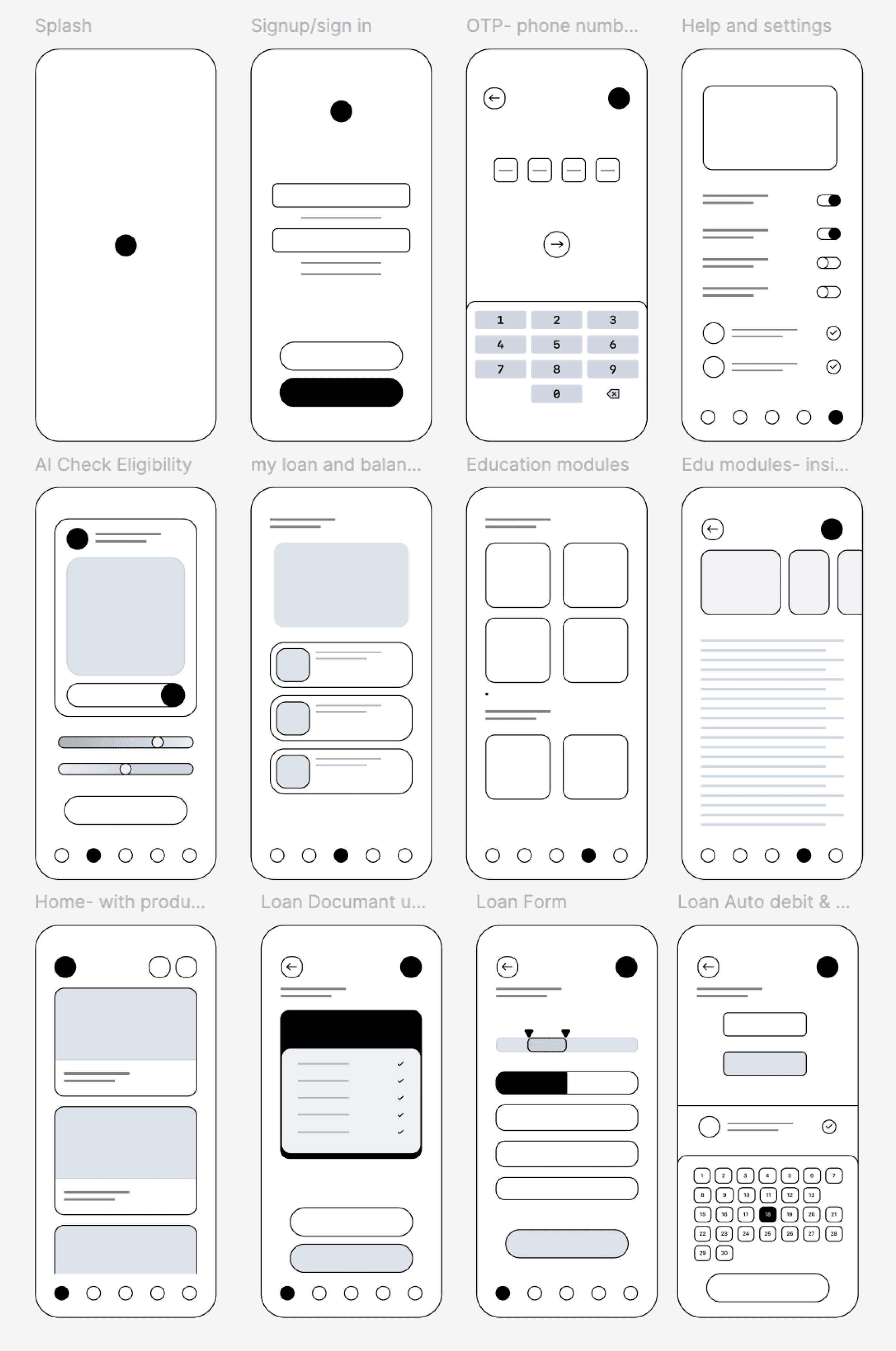

Wireframes

A basic sketch was done to navigate through the initial design process. Helped in understanding the main functionalities & screens that play a big role while prototyping a mobile first approach.

Unique

Features

Based on user interviews, the key innovative features are listed below will help our product stand apart from the ones existing in the market.

Instant loan eligibility calculator

Financial transparency is key. Without entering complete form details, an instant calculator can give user an estimate without submitting documents based on how much loan an user is eligible for based on the basic details which include income and the frequency in which the user can pay it back.

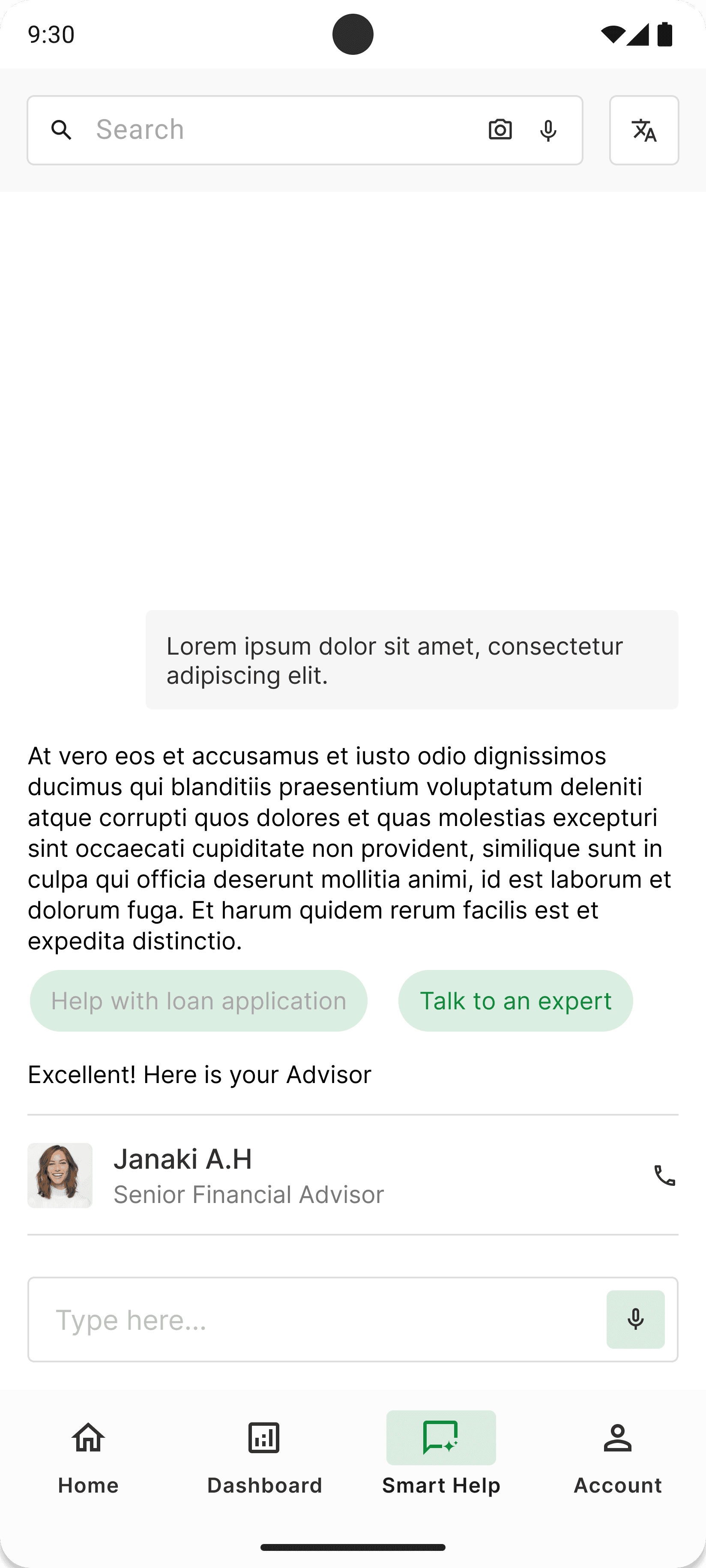

AI powered chat support

Provision for a 24/7 AI-powered chatbot + quick call/chat human support for loan inquiries & issue resolution. This can also help users in simplifying loan applications through voice commands.

Auto fill & document scanning

By having a upload for document AI can complete the form on user’s behalf and they just have to simply proof read it and edit if required

Free financial educational modules

Built-in financial literacy modules with calculators to help users manage debt and improve creditworthiness.

Support in Indian regional languages

In-app language switches in regional languages will engage users with varied socio-cultural background who would want to benefit from getting micro loans in improving their standard of life.

Gridding

Margin 16px

Gutter 16px

Font Used

Inter (Light, Regular,Medium, Semibold)

Minimalistic & Clean Look

Ensures a smooth reading experience, even for long texts.

Works well with multiple languages ensuring seamless localisation.

Viewport

Samsung Galaxy S22 / S23

Google Pixel 7 / Pixel 8

OnePlus 10 Pro

412 x 915 suitable for Android Mobile Screens

Colors Used

Prototyping

& UI Design

A figma prototype to translate insights into a realistic flow which will help us gather user feedback before the final development takes place.